Should You Make a Large Home Downpayment?

It's essential to consider your own financial situation and goals before deciding on the right down payment amount for you. It's important to strike a balance that aligns with your budget and long-term financial plans. Ultimately, the ideal down payment amount varies from person to person.

There are several benefits to making a large down payment when purchasing a house:

-

Lower Monthly Mortgage Payments. A larger down payment reduces the amount you need to borrow, resulting in lower monthly mortgage payments. This can make homeownership more affordable and reduce financial stress.

-

Lower Interest Costs. With a larger down payment, you'll typically qualify for a lower interest rate on your mortgage. This can lead to significant savings over the life of your loan.

-

Equity Buildup. A substantial down payment immediately builds equity in your home. This means you own a larger portion of the property from the start, which can be beneficial if you decide to sell or refinance in the future.

-

Avoiding Private Mortgage Insurance (PMI). When you put down less than 20% of the home's purchase price, lenders often require you to pay for PMI to protect their investment. A larger down payment can help you avoid this additional cost.

-

Improved Loan Approval Chances. A substantial down payment demonstrates your financial stability and commitment to the purchase, which can increase your chances of loan approval, especially if you have a less-than-perfect credit history.

-

Shorter Loan Term. With a larger down payment, you may choose a shorter loan term (e.g., 15 years instead of 30 years). This can help you pay off your mortgage faster and save on interest.

-

Lower Risk of Negative Equity. A larger down payment reduces the risk of owing more on your home than it's worth (negative equity), which can protect you in case of a downturn in the housing market.

-

Greater Flexibility. A substantial down payment can provide you with more financial flexibility, making it easier to handle unexpected expenses or invest in home improvements.

-

Competitive Advantage in Bidding. In a competitive housing market, a larger down payment can make your offer more attractive to sellers because it signals your seriousness as a buyer.

-

Peace of Mind. Knowing that you've made a significant investment in your home can provide peace of mind and a sense of ownership from day one.

It's crucial to strike a balance that aligns with your financial stability, goals, and comfort level. Taking the time to evaluate these factors will help you make a well-informed decision and set you on a path to successful homeownership.

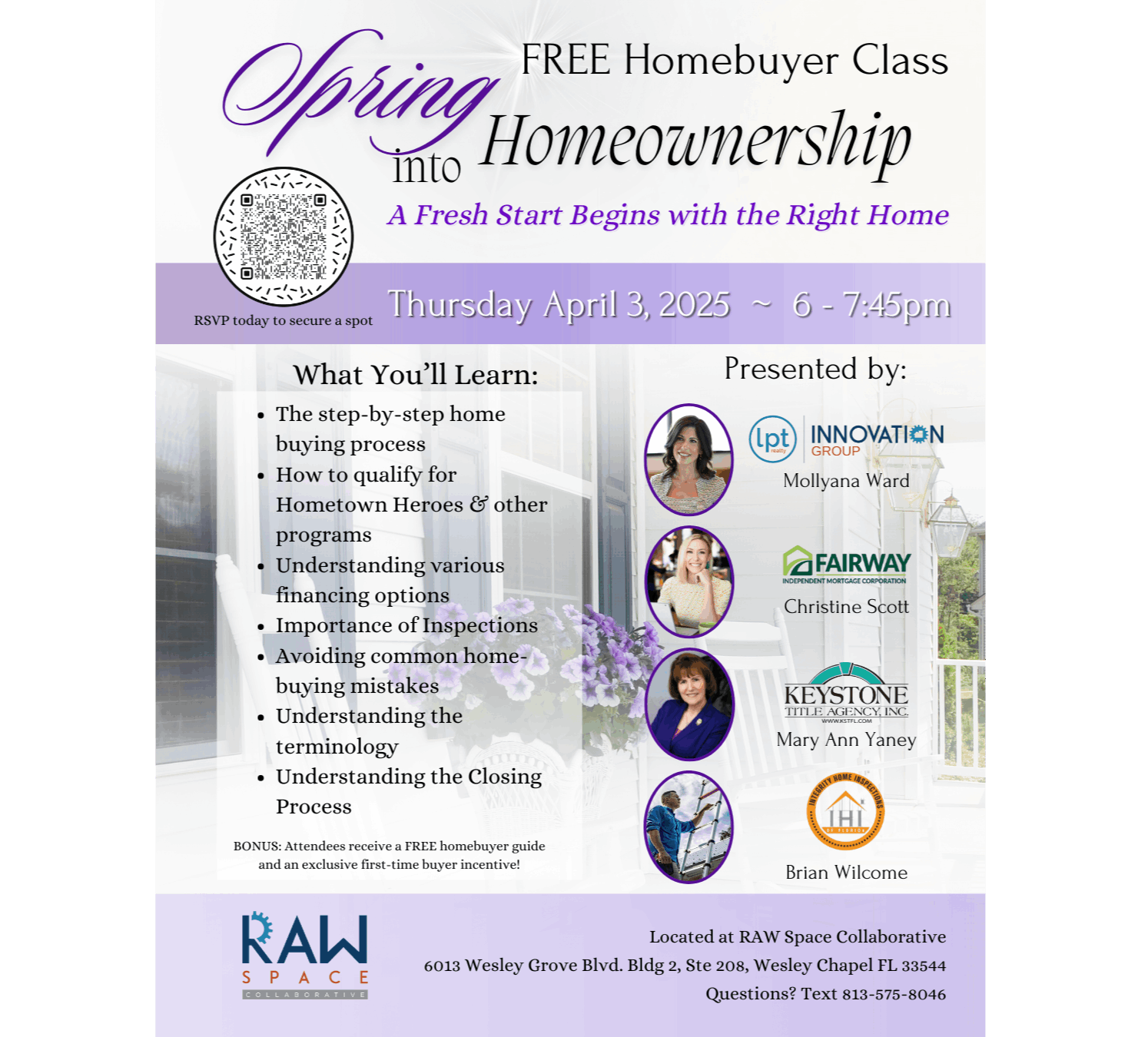

Ready to move to your dream home? Reach out ot us, the Innovation Group is ready to help make it a smooth transition for you and your family!

Categories

- All Blogs (26)

- April Market Statistics (1)

- beachfront (2)

- best city to move (8)

- best florida city (8)

- best place to buy (5)

- best real estate agent (7)

- buy a house (11)

- buy a house in Florida (12)

- buy a second home (6)

- buy an investment house (5)

- buyers agent (5)

- canada (4)

- canadian (4)

- Canadian realty (4)

- Canadians moving to Florida (6)

- florida (6)

- hockey (2)

- hockeylife (2)

- homebuyer (10)

- homes for sale (6)

- Housing Market Statistics (2)

- innovation (4)

- investment realty (5)

- listings (4)

- Market Statistics (1)

- move to Florida (9)

- new listings (4)

- Realty (4)

- realty companies (4)

- realty company (4)

- realty in florida (5)

- rent a house (4)

- rent a house in Florida (5)

- second home (5)

- second home in Florida (6)

- selling real estate (6)

- snowbird (4)

- snowbirds n Florida (4)

- Sunset views (3)

- Tampa Bay lightning (2)

- turn key realty (4)

- Water views (2)

- Waterfront home (2)

- Waterfront property (2)

- where to move in Florida (6)

- Zillow (4)

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "